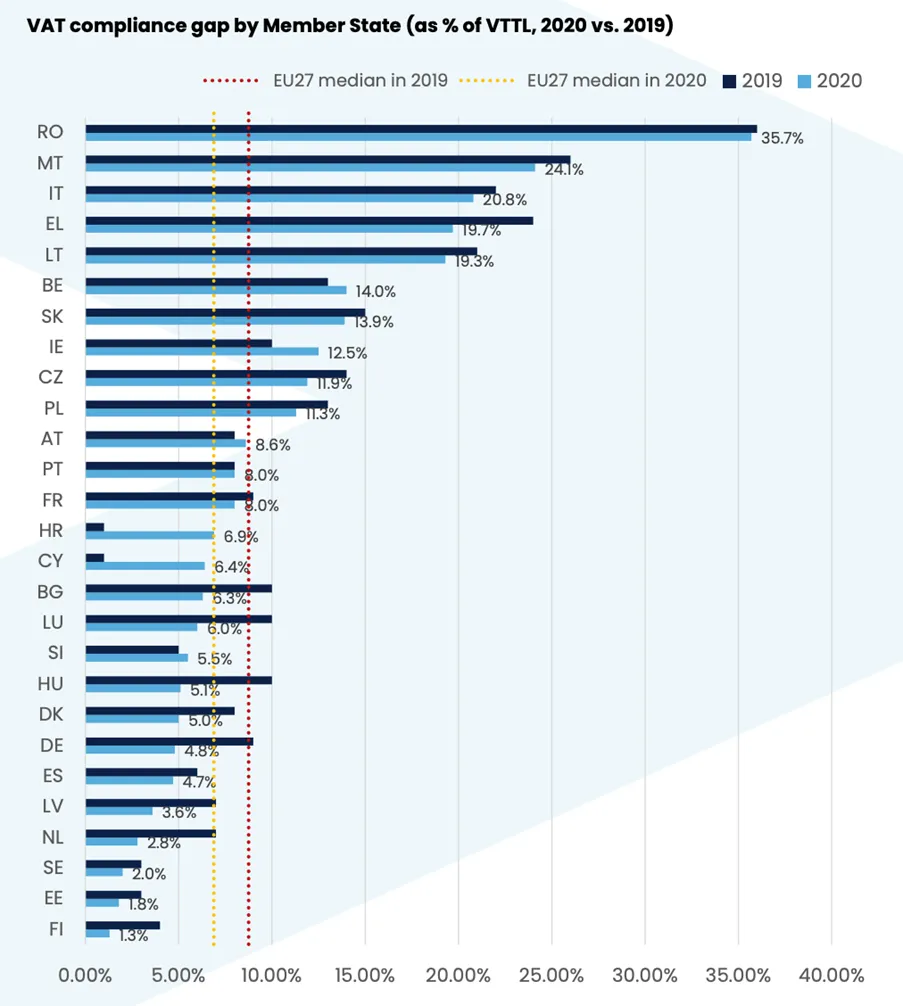

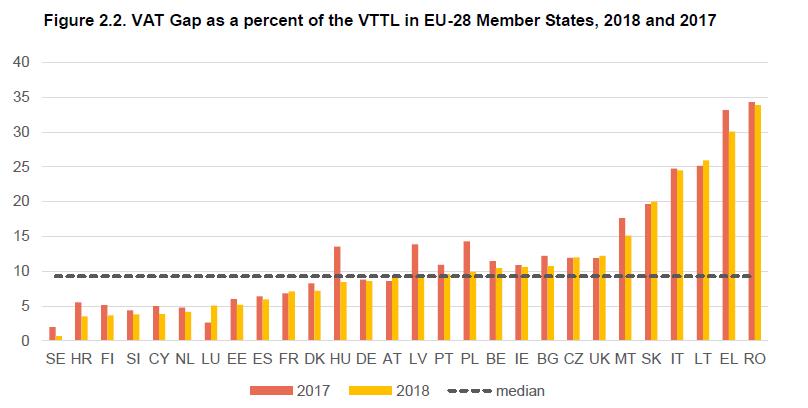

Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | PLOS ONE

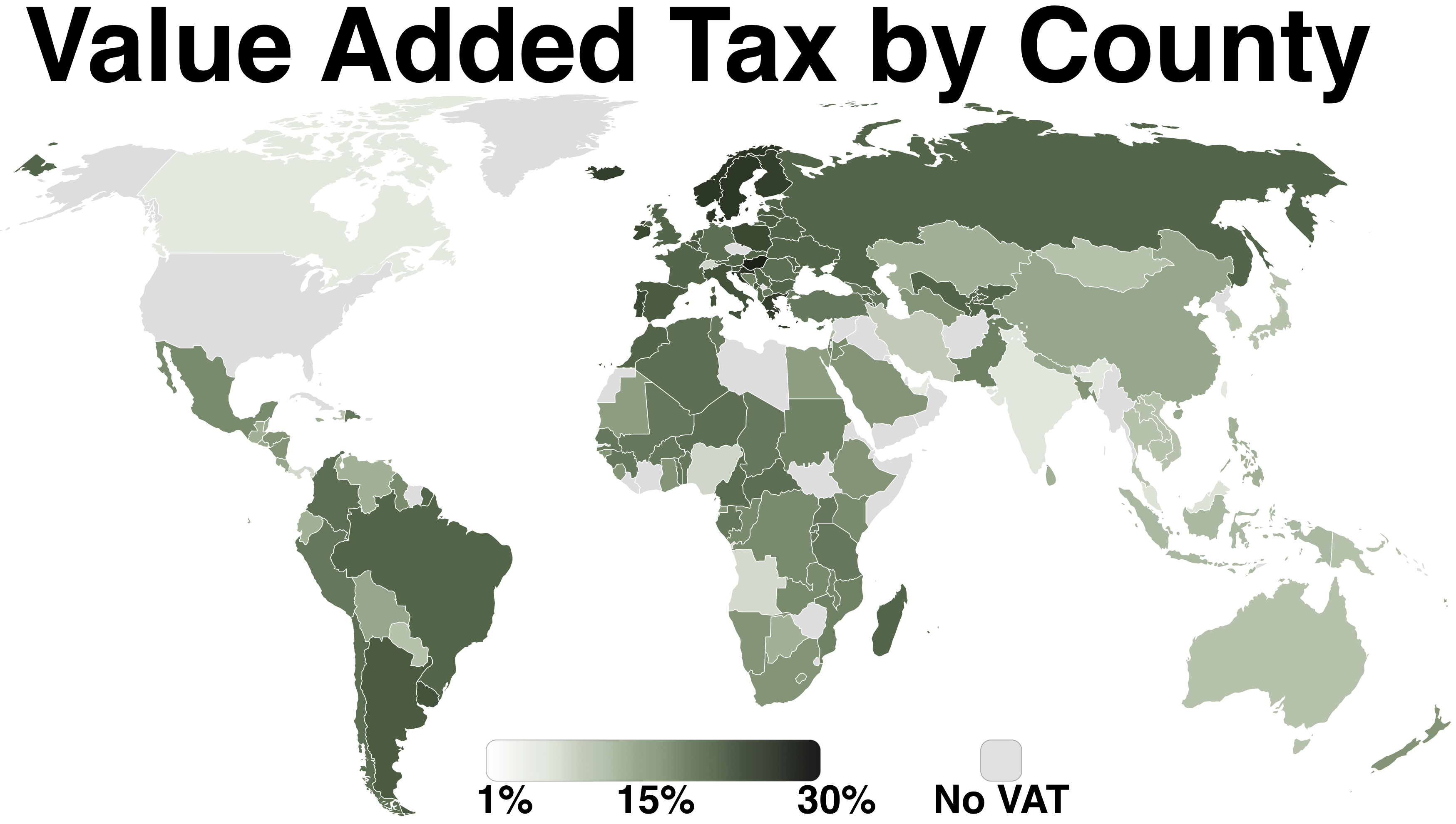

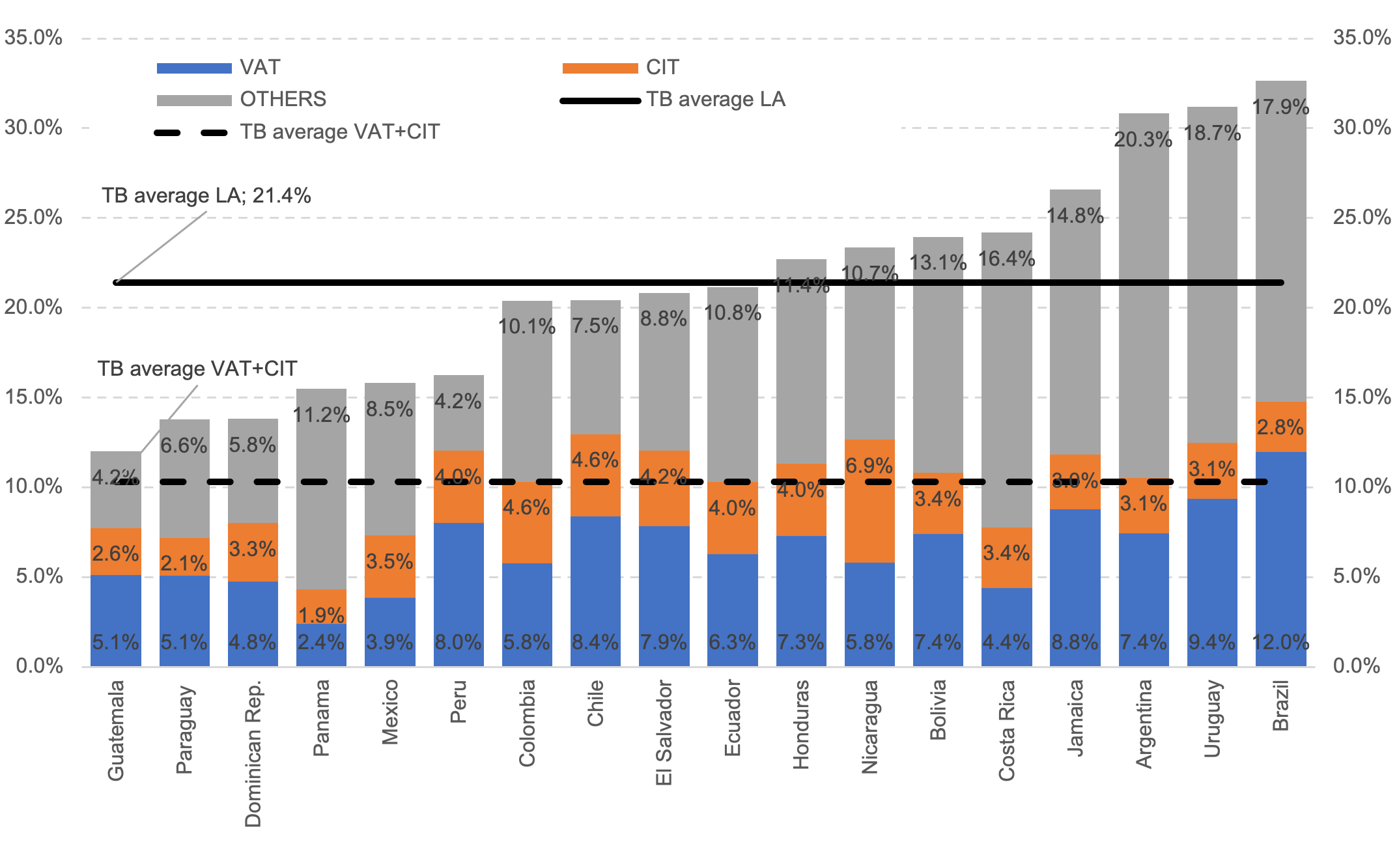

Revenue Efficiency of Value Added Tax and Corporate Income Tax | Inter-American Center of Tax Administrations

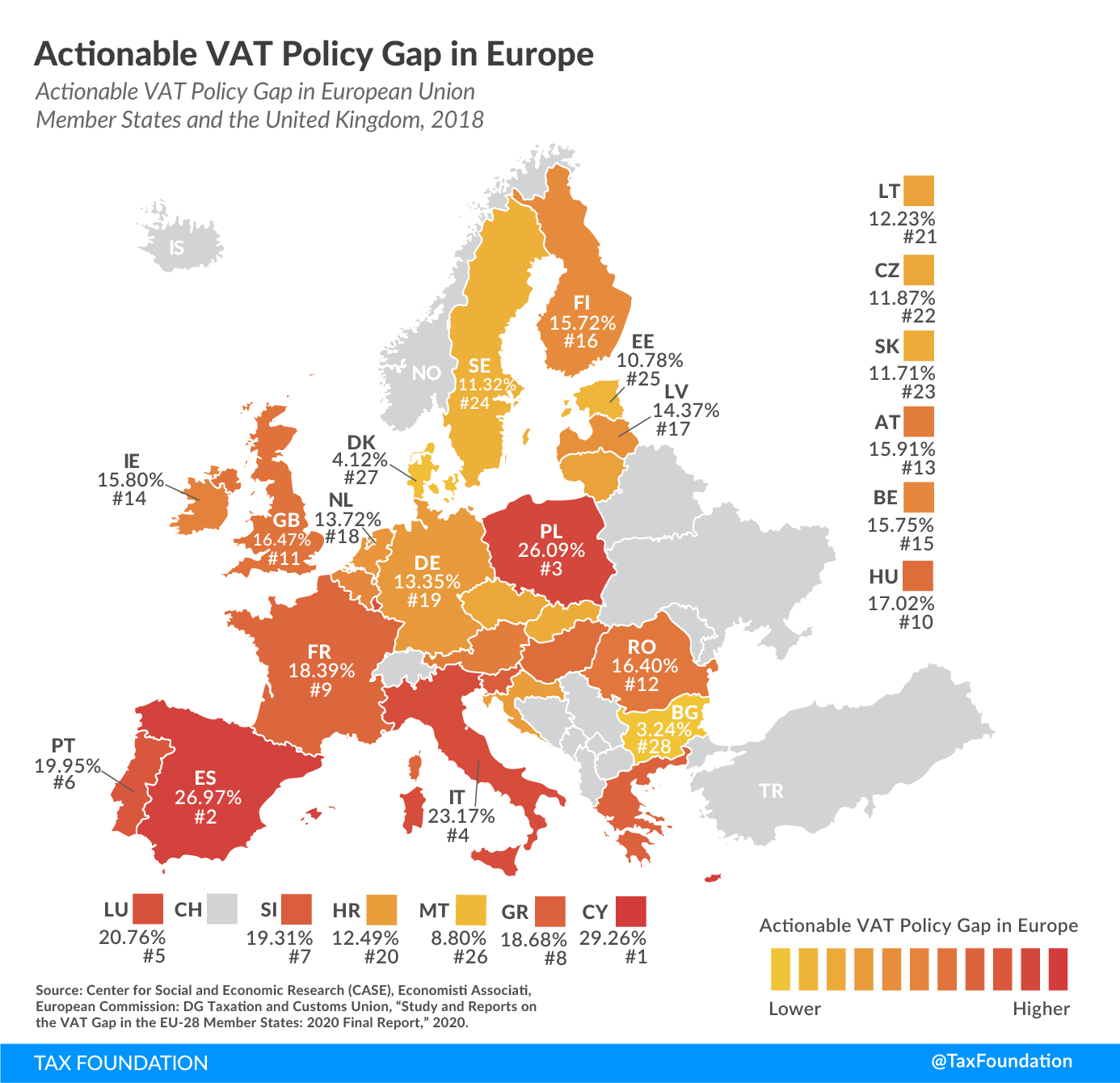

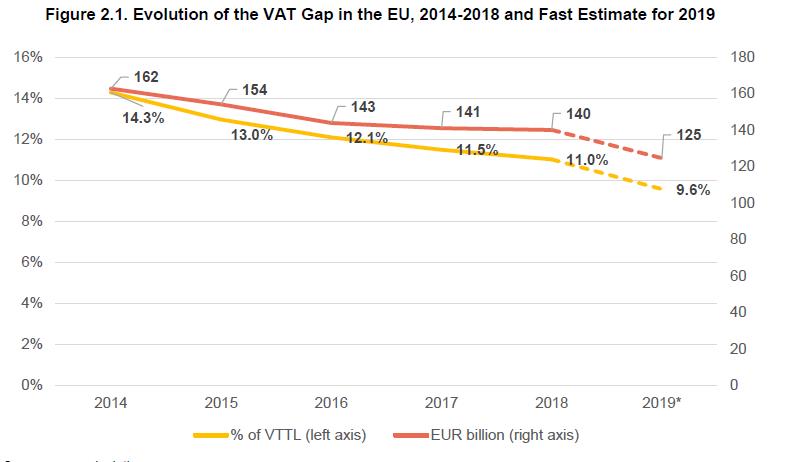

VAT Gap in Poland: policy problem and policy response The goal of proposed research project is to comprehensively examine the ev

ESTIMATION OF INTERNATIONAL TAX PLANNING IMPACT ON CORPORATE TAX GAP IN THE CZECH REPUBLIC. - Document - Gale Academic OneFile